Key Takeaways

- This affects Venmo, Etsy, Amazon, Paypal, and similar payors.

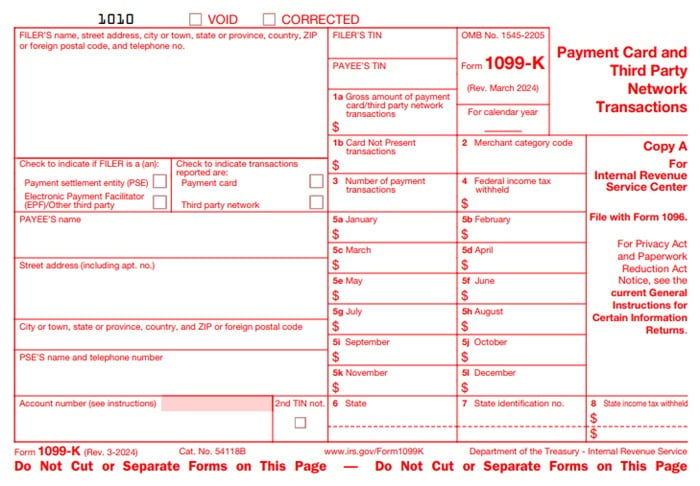

The IRS today announced that the threshold for third-party payors such as Venmo and Paypal to issue Form 1099-K will be at $5,000 in payments for 2024. This confirms plans announced earlier this year. From the IRS announcement:

Notice 2024-85 also announces for calendar year 2024, that the IRS will not assert penalties under section 6651 or 6656 for a TPSO’s failure to withhold and pay backup withholding tax during the calendar year.

The 2021 American Rescue Plan required third-party settlement organizations to issue 1099-Ks for taxpayers receiving $600 or more. The threshold had been $20,000.

The IRS has delayed the implementation of this requirement repeatedly, leaving the old rules in place. 2024 will be the first year it will enforce the rules at the $5,000 level.

Prior coverage: Additional Transition Year for 1099-K Reporting Requirements

Link: Notice 2024-85

We're Here to Help